[ad_1]

Tremendous Micro Laptop (NASDAQ: SMCI) inventory misplaced substantial floor in Monday’s buying and selling. The corporate’s share value closed out the day by day session down 6.4% in keeping with information from S&P World Market Intelligence. Notably, the pullback occurred even because the S&P 500 index climbed roughly 0.8%.

Supermicro inventory was added to the S&P 500 at present, changing Whirlpool within the benchmark index. The transfer was introduced on March 4, and the server specialist’s inventory posted explosive features on the information. Even with at present’s pullback, Supermicro’s share value continues to be up roughly 11% because it was introduced that the corporate was being added to the index.

Being included within the S&P 500 index is usually a bullish signal for a inventory. As soon as an organization turns into a part of the S&P 500, traders who buy exchange-traded funds (ETFs) that observe the index may also successfully be shopping for shares of that firm’s inventory. In flip, that tends to extend demand and ship its share value greater. Being a part of the S&P 500 can also be a prestigious distinction, and it might probably bolster the attraction of a nonetheless comparatively little-known firm, similar to Supermicro.

However on this case, it appears like some traders bought overly excited in regards to the short-term pricing impression that really being added to the index would have. Whereas the inventory had truly been up as a lot as 7.4% early within the day’s buying and selling, many shareholders moved to take income shortly after the market opened.

Is Supermicro inventory nonetheless a wise purchase?

Even with at present’s sell-off, Supermicro has been one among this 12 months’s greatest performing synthetic intelligence (AI) shares. The corporate’s share value has rocketed roughly 252% greater throughout 2024’s buying and selling due to AI-driven demand for its high-performance rack servers.

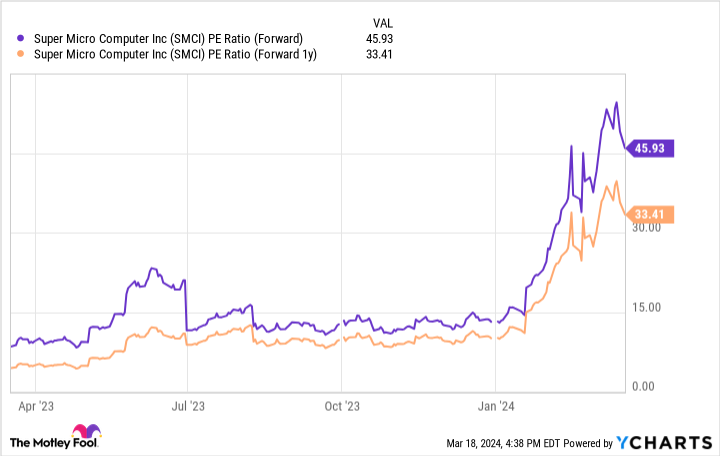

Supermicro inventory is now buying and selling at roughly 46 instances this 12 months’s anticipated earnings and a bit below 33.5 instances subsequent 12 months’s anticipated income. In the meantime, the corporate has a ahead price-to-earnings development (PEG) ratio of roughly 0.5 and a one-year ahead PEG of roughly 0.6. Sometimes, a PEG of lower than one is considered as a sign {that a} inventory is undervalued.

Primarily based on the corporate’s current gross sales and earnings development and the emergence of AI-related tailwinds, it is not unreasonable to suppose that Supermicro inventory can nonetheless ship huge wins over the long run. However traders ought to method the inventory with the understanding that near-term efficiency may very well be bumpy on the heels of such explosive development. With that in thoughts, taking a dollar-cost-averaging method to the inventory appears like a wise technique for bulls proper now.

Must you make investments $1,000 in Tremendous Micro Laptop proper now?

Before you purchase inventory in Tremendous Micro Laptop, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Tremendous Micro Laptop wasn’t one among them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of March 18, 2024

Keith Noonan has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.

Tremendous Micro Laptop Fell After Being Added to the S&P 500 At this time — Is This a Probability to Purchase the AI Inventory? was initially printed by The Motley Idiot

[ad_2]