[ad_1]

US consumer-price information within the coming week, arriving on the heels of surprisingly sturdy jobs numbers, is projected to point out a glacial slowdown in underlying inflation that explains the Federal Reserve’s cautious strategy to decreasing rates of interest.

Article content

(Bloomberg) — US consumer-price data in the coming week, arriving on the heels of surprisingly strong jobs numbers, is projected to show a glacial slowdown in underlying inflation that explains the Federal Reserve’s cautious approach to lowering interest rates.

The March core consumer price index, a measure of underlying inflation that excludes food and fuel, is seen rising 0.3% from a month earlier after a 0.4% advance in February. Wednesday’s report is expected to show a similar increase in the overall CPI.

Advertisement 2

Article content material

Article content material

The core value gauge is projected to have climbed 3.7% from a 12 months in the past, which might mark the smallest achieve since April 2021. Whereas the annual determine is nicely beneath the 6.6% peak reached in 2022, progress extra not too long ago has been uneven.

The intently watched inflation figures observe the newest month-to-month jobs report, which exceeded expectations for a fifth straight month. Whereas Fed officers have pointed to moderating labor demand over the previous 12 months as a doable precursor to charge cuts, the 303,000 bounce in March payrolls might increase questions over the extent of that cooling, and its implications for inflation.

Quite a few Fed officers talking over the previous week have been constant of their messages that it’s applicable to attend till there’s a clearer indication that inflation is slowing towards their goal earlier than taking step one towards decreasing borrowing prices.

What Bloomberg Economics Says:

“The main focus now shifts towards the inflation trajectory, presently a extra crucial issue within the Fed’s response perform. We count on the March CPI report to point out a modest slowdown within the month-to-month tempo of core inflation to 0.3% — which remains to be in step with the Fed’s annual core PCE inflation goal of two.0%. Even when annual headline inflation flutters round 3.0% by means of year-end, persistent disinflation within the core ought to enable the Fed to chop charges this summer season.”

Article content material

Commercial 3

Article content material

— Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou, economists. For full evaluation, click on right here

US central bankers meet subsequent on April 30-Might 1 and are extensively anticipated to carry charges regular. Minutes of their March gathering are due Wednesday, and merchants will even monitor remarks from New York Fed President John Williams at an occasion on Thursday.

Learn extra: Blowout Jobs Knowledge Elevate Likelihood of Delayed, Fewer Fed Charge Cuts

A report Thursday on costs paid to US producers is forecast to point out a extra reasonable month-to-month advance. Nonetheless, latest will increase within the costs of crude oil, copper and another commodities recommend much less items disinflation within the coming months.

- For extra, learn Bloomberg Economics’ full Week Forward for the US

Turning north, the Financial institution of Canada is extensively anticipated to take care of its key coverage charge at 5% on Wednesday, whereas revising financial projections to mirror stronger-than-expected progress firstly of this 12 months and the long-term impacts of the Trudeau authorities’s cap on non permanent residents.

Elsewhere, central banks from New Zealand to the euro space to Peru are additionally set to carry, whereas economists are break up between a lower and a pause in Israel. In the meantime, former Fed Chair Ben Bernanke is scheduled to ship a evaluate of Financial institution of England forecasting errors on Friday.

Commercial 4

Article content material

Click on right here for what occurred final week and beneath is our wrap of what’s developing within the international financial system.

Asia

A raft of central banks in Asia maintain conferences within the coming week, with authorities within the Philippines, New Zealand, Thailand and South Korea all anticipated to carry coverage regular.

The main focus will fall on any hints indicating after they would possibly pivot to easing cycles, with RBNZ Governor Adrian Orr anticipated to present an replace Wednesday on the timeline for normalized charges as New Zealand’s financial system continues to wobble.

In information, China’s client inflation is projected to gradual to 0.4% in March, whereas the decline in producer costs might deepen a tad to 2.8%, backing the case for extra stimulus. Exports are anticipated to drop for a second month.

India will get inflation figures for March and industrial output for February.

In Japan, money earnings information might present actual wages fell for a twenty third month in February, a pattern that’s anticipated to finish when wage hikes for the brand new fiscal 12 months — the largest in additional than three a long time — kick in.

- For extra, learn Bloomberg Economics’ full Week Forward for Asia

Europe, Center East, Africa

Commercial 5

Article content material

The European Central Financial institution is about to carry charges regular on Thursday in what’s universally anticipated to be the ultimate such pause earlier than it embarks on financial easing in June. President Christine Lagarde’s phrases will probably be scoured for clues on what would possibly occur after that, with some officers already pushing for back-to-back strikes.

After final week’s weaker-than-anticipated inflation studying, policymakers gained’t get a lot extra information forward of the assembly, although the quarterly bank-lending survey on Tuesday might present some perception.

European finance chiefs are scheduled to collect for his or her common assembly in Luxembourg on the finish of the week. They’ll focus on exchange-rate and inflation developments and the area’s competitiveness.

Turning east, Hungary is scheduled to publish minutes of its newest coverage assembly, at which it lowered its benchmark by 75 foundation factors and mentioned it will proceed to dial again easing. Serbia is about to maintain charges unchanged.

Russia will get inflation information on Wednesday, the identical day that Financial institution of Russia Governor Elvira Nabiullina might current an annual report within the State Duma.

Commercial 6

Article content material

In Britain, GDP figures on Friday are prone to verify a second month of progress in February, placing the financial system on observe for a gentle restoration after the shallow recession in 2023. The BOE that day will launch a report from Bernanke, setting out suggestions for the way officers can enhance forecasting and communication after criticism they have been gradual to acknowledge the inflation disaster that began after the pandemic.

Israel’s charge choice on Monday is prone to be a detailed name between a maintain and a 25 foundation level lower. A lower would enhance the financial system because the six-month battle in Gaza continues to weigh on consumption and sectors from tourism to building. Nevertheless it might additionally add to strain on the shekel, which has weakened since early March.

Uganda is prone to be extra sure, with analysts predicting its financial coverage committee will go away the important thing charge unchanged after growing it by 50 foundation factors to 10% at an unscheduled assembly final month. That’s as inflation has began to ease once more and the foreign money is strengthening in opposition to the greenback.

- For extra, learn Bloomberg Economics’ full Week Forward for EMEA

Commercial 7

Article content material

Latin America

Getting the inflation genie again within the bottle is giving central bankers round world suits, as Chile’s Rosanna Costa, Mexico’s Victoria Rodriguez and Brazil’s Roberto Campos Neto can attest.

Knowledge in Chile will doubtless present client costs eased again close to January’s 3.8% studying after leaping in February. The central financial institution has marked up its 2024 forecast to three.8% from 2.9%.

In Mexico, the place the disinflation course of has confirmed bumpy and protracted, the early consensus is for each the full-month and bi-weekly readings to have re-accelerated.

Brazil, which truly acquired inflation beneath goal way back to final June earlier than a 203 basis-point third-quarter surge, is prone to see client costs print decrease for a sixth straight month, firmly inside the central financial institution’s tolerance vary however nonetheless nicely above goal.

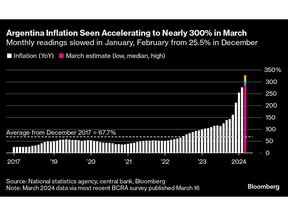

Final up is Argentina, the place March month-to-month information out might put up a single-digit rise, in response to a member of President Javier Milei’s advisory council. Analysts surveyed by the central financial institution see it barely over 14%, sizzling sufficient to ship the year-on-year print up inside a cat’s whisker of 300%.

Peru’s central financial institution on Thursday might go for a second straight charge pause at 6.25% after March inflation figures exceeded all economist estimates.

- For extra, learn Bloomberg Economics’ full Week Forward for Latin America

—With help from Robert Jameson, Brian Fowler, Laura Dhillon Kane, Reed Landberg, Paul Wallace, Monique Vanek, Tony Halpin and Alexander Weber.

Article content material

[ad_2]